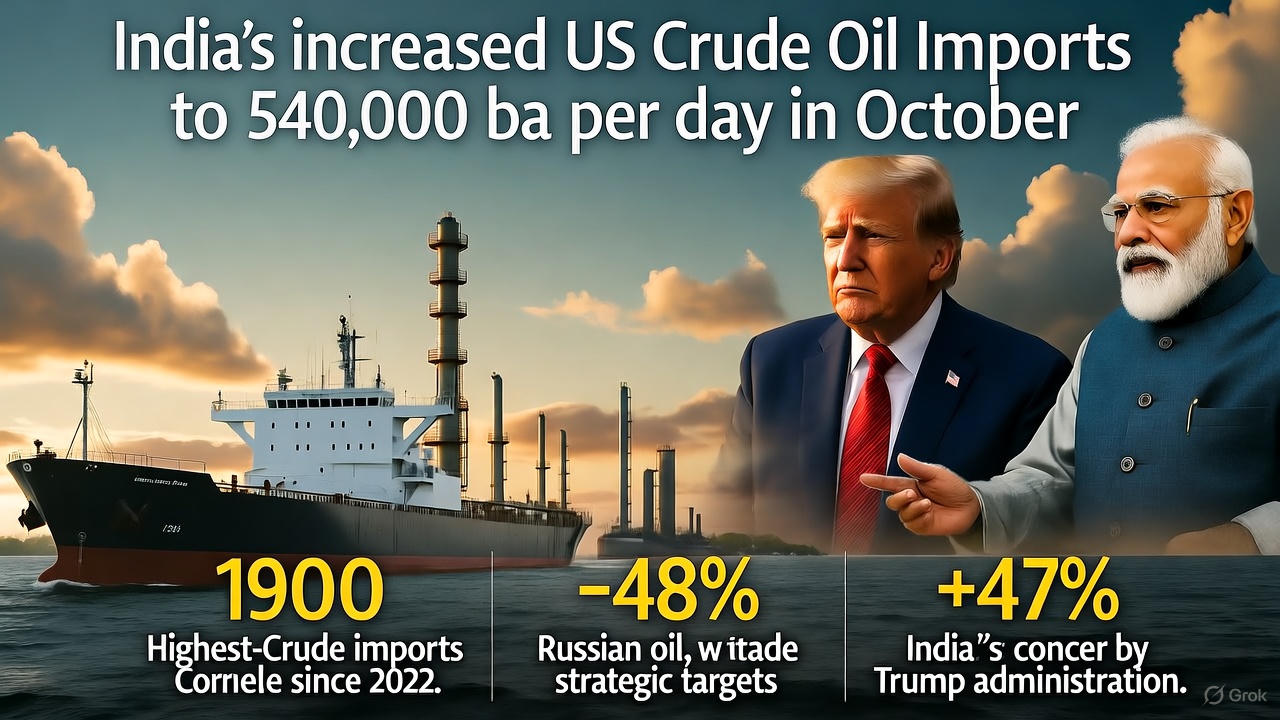

Refernce to Times of India. India has been rapidly boosting its crude oil imports with the United States to 540,000 barrels per day (bpd) in October which is the highest point since 2022. The decision is an indication of the strategic will of India not to overdepend on Russian oil, and at the same time, to reduce trade conflicts with the Trump administration.

India Increases Oil Importation to help equalize Trade Relations and Energy Security.

India increased its oil imports with the US, according to Kpler data, as refiners wanted to diversify their supply to the market other than rely on Russia. The move also coincides with the effort by India to put trade relations between India and the Donald Trump administration in smooth sailing owing to the introduction of the 50% tariffs on Indian exports recently.

A report issued by the PTI pointed out that the on-the-rise buying activities of India pointed to a dual-purpose approach – to meet its energy demands and at the same time avoid any negative relationship with Washington.

The reasons why India is purchasing increasing US Crude.

Analysts attribute this boom to market and economic forces.

Sumit Ritolia, Lead Research Analyst, Refining, Supply & Modelling at Kpler clarified the rise by the fact that the price gap (Brent-WTI differential) was favorable, there was an opportunity of arbitrage and that Chinese demand was low and thus WTI Midland crude was very appealing to Indian refiners.

Statistics indicate that the October could be closing in close to 575,000 bpd, whereas imports in November are likely to be around the 400,000-450,000 bridges as compared to the average of 300,000 bpd at the beginning of this year.

To show the US that it is collaborating with them, Indian refiners have also increased the purchases of WTI Midland and Mars crude types with the aim of enhancing the bilateral energy relationships.

India is forced to diversify as New Sanctions on Russian Oil Firms.

The US imports increase is against the backdrop of growing US sanctions on Russian oil giants Rosneft and Lukoil, which is also a major supplier to India.

The Trump administration has provided a deadline of November 21 to complete transactions with these companies, and both state owned companies and Indian private refiners are considering other options in sourcing and compliance.

In the present state, Russian oil supplies 34 percent of the total crude oil demand in India, of which Rosneft and Lukoil produce about 60 percent of the crude oil demand. Nonetheless, the most recent sanctions may compel India and China to reduce or stop buying Russian oil.

Will US Oil substitute Russian Crude?

The US oil imports have increased, however, Russia is the biggest supplier of oil to India with almost a third of the total crude imports by India. Iraq and Saudi Arabia come second and third respectively.

According to Ritolia, although the surge highlights the refining flexibility and geopolitical adaptability of the Indian country, it is not a long-term structural change, but rather a short-term arbitrage. An increase in freight prices, increase in freight time, and the lighter and naphtha-heavy yield of WTI may mean that future growth is hampered.

However, the trend also postulates how India is becoming increasingly energy dependent on the US and its overall energy diversification, energy security, and diplomatic equilibrium strategy.

The balancing act by India between Moscow and Washington.

This change also comes after the recent statements by Trump who said that Prime Minister, Narendra Modi assured him that India had eliminated all the possibility of buying Russian oil. India has not ratified such agreement though as it has stressed on its continued diversification of energy sources.

Facing the November 21 deadline of the imposition of sanctions, Indian refiners are getting ready to make potential supply changes and maintain energy stability and global trade regulations.

Looking for website Designing ? Connect with wovved today.